Housing is Still Looking Strong

Filed under: Market Comentary

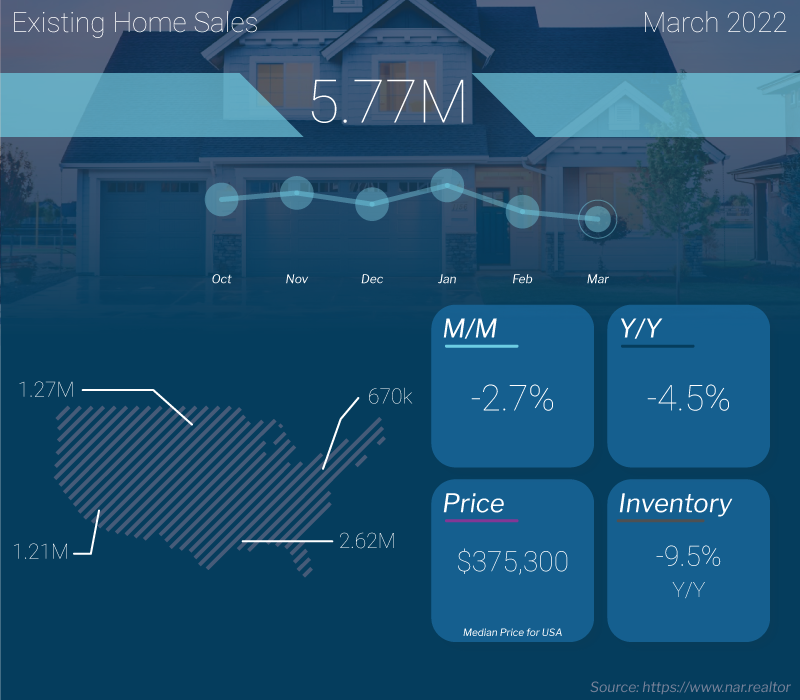

This morning, important monthly housing data came out. The numbers show that the market is continuing to stay strong. There are some possible hurdles ahead, but things are still looking good currently.

Annual Home Sales

5.77 million annualized units (which is strong to pre-COVID) for existing homes sold. One of the other numbers that really jumped out at me is that 950,000 units is the inventory available at the end of March.

This number is important because people are talking about how a crash is coming – I don’t know if a crash is coming or not. But reports this time of year from 2008 had inventory available of 4.2 – 4.4 million. Which means that we had more than 4x more inventory on the market.

Inventory Matters

Additionally, we were selling at a $4.2 to $4.4 million dollar annualized pace in 2008. Which meant we had about a year’s worth of inventory at the time. Right now, we’re barely over a month of inventory. Of course, buyers can back out of the market at any time, but a LOT of buyers would have to back out – which would be unexpected.

Month-over-month, we saw an increase in inventory of about 12% (from February to March). It’s important to note that this happens every single year, so it isn’t too unusual. It’s the normal cycle of business in the real estate industry.

What is Happening with Interest Rates

Overall, things are staying strong. Keep in mind that closings happening in March are the deals that were locking in back in January and February. At the time, most interest rates had 3’s and 4’s in front of them. Now, the next few months will be very important because we are getting into a time where rates are starting to cross over into the 5% range. Along with that, I’m seeing some sticker shock on payments.

It will be interesting to see what happens in the next few months. I certainly hope that things will stay resilient. My opinion is that things will start to flatten out in terms of pricing, which could be really healthy for the industry.

Also, we might not be done seeing the increase in interest rates. If inflation continues going up, then rates will continue to run.

This is a little bit of market data that shows things are still good in the industry right now. I’m always here to answer questions if you would like more information.

Franklin Loan Center | NMLS 237653

Licensed by the Department of Financial Protection and Innovation under the California Residential Mortgage Lending Act, 4131316

Franklin Loan Center | NMLS 237653

Licensed by the Department of Financial Protection and Innovation under the California Residential Mortgage Lending Act, 4131316