Currently Browsing: Market Comentary

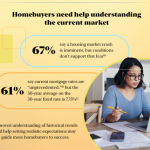

These Numbers Don’t Jive!

Today I want to run through some numbers because they are worth pointing out. This data is based on a survey done last month by NerdWallet. The two headlines: 67% of all buyers think there is a market crash coming 61% say…

Read More February 16, 2023

Who is Buying Real Estate Right Now?

On Friday, we received data about existing home sales. There were a few things that popped out to me: Housing Prices Comparison The first data point looks at housing prices in December 2022 vs. December 2021. The numbers show that housing prices…

Read More January 25, 2023

It’s Happening!

It’s starting to look like the market is moving as we have been predicting: inflation is showing signs of dropping off, and we hope that it will continue to bring rates down. We watched last year: as inflation ran, high interest rates…

Read More January 18, 2023

Where’s the Housing Crash?

There are so many people predicting what to expect in the real estate market for 2023. Of course, we are seeing these conversations, because it happens annually around this time of year. It’s interesting to see the varying opinions – people are…

Read More January 11, 2023

What Could Be More Exciting Than the Fed Meeting Minutes?

Welcome to the first week of 2023! Happy New Year! At 11am PST, the Fed released their meeting minutes from last month’s meeting on December 12th. This always happens: they have the meeting, then the meeting minutes are released a few weeks…

Read More January 5, 2023

Are Mortgage Delinquencies on The Rise?

Core Logic puts out a report every month about mortgage delinquencies, which is obviously an important statistic about the heath of the of real estate market overall. Mortgage Delinquencies are Trending Down The main headline shows 30 days past due or greater….

Read More December 28, 2022

November 2022 Market Conditions for SW Riverside County

New data was just released for November 2022 for Southwest Riverside County. I’ve taken the time to go through this report in today’s video. It is a bit longer than my normal video, but for those of you in the Real Estate…

Read More December 14, 2022

And the National Housing Survey Says…

Today I’m sharing details from a report that Fanny Mae released today: the Home Purchase Sentiment Index (HPSI). The report tries to gauge consumer sentiment about buying a house right now. It brings different factors together: Are you likely to buy? Are…

Read More December 7, 2022

New Loan Limits and Inflation Data Coming Tomorrow

A few quick industry updates I want to share with you today. I watch the trends and headlines so I can share this information with my clients, and we can see how mortgages might be affected going forward. Conforming Loan Limits The…

Read More November 30, 2022

Could Right Now Be a Better Time Than You Think to Purchase a Home?

Is right now a better time than you think to purchase a home? You’ve heard me say this many times lately, but I’m going to share the reminder: right now, there are many headlines that make it seem like a bad time…

Read More November 16, 2022

There is so Much Happening: What Can We Expect in Real Estate?

There is so much data coming in that has the potential to have a big impact on real estate. I want to run through some of these details and explain how it appears to be affecting the industry. Fed Day: Rates Went…

Read More November 9, 2022

The Latest Foreclosure Data: Is It Misleading?

Black Night issued the month-over-month foreclosure data. I’ve heard a lot of people talking about this topic: the wave of foreclosures that are going to be coming. The current reality and good news are that according to the numbers, foreclosures appear to…

Read More October 27, 2022

Who Needs a Hug?

Who in this crazy business needs a hug right now?! According to Freddie Mac, interest rates are over 7%. It feels like we’ve finally reached the spot where we are only dealing with people who really need to move. It’s a crazy…

Read More October 19, 2022

What Does Oil Have to Do with the Mortgage Business?

Do you know that there is a connection between oil and the mortgage business? Most people would never make this association, which is why I wanted to talk about it. What Did OPEC Decide? OPEC (The Organization of the Petroleum Exporting…

Read More October 6, 2022

2/1 Buy Downs Explained

2/1 buy downs is a topic that has been trending lately, but I still have a lot of people who are wondering what it is and why they would do it. Here’s what you need to know: What is a 2/1 Buy…

Read More September 29, 2022

It’s Fed Day! Also, Next Week: Best Week of the Year to Purchase a House

Today is Fed Day: as expected the Fed increased rates by three-quarters of a percent. The mortgage/bonds market is having a muted response. So far there isn’t too much movement. If you’ve been watching the trends, it’s been an ugly ride for…

Read More September 22, 2022

Housing Data Surprisingly Strong Considering the Run in Interest Rates

It’s no surprise that real estate volumes are slowing down, and there are less buyers in the market. Recent housing data is showing that existing homes sales are down by almost 30%. What’s interesting is that some of the price appreciation numbers…

Read More August 25, 2022

Are Home Buyers Finally Getting Their Chance to Negotiate?

We’ve been talking about the real estate market a lot lately, and we are seeing the market shift quite a bit right now. There is significantly more inventory in areas, which is giving the opportunity for buyers. Finally! Is It Finally a…

Read More August 18, 2022

Buying Real Estate in the Metaverse – And Inflation Data

https://www.youtube.com/watch?v=5AUJo1e2my4 To start on a much lighter note: did you know that you can buy real estate in the Metaverse already? I recently saw an interview with Mark Cuban and they were talking about how there is a piece of land next…

Read More August 10, 2022

The Recession Has Begun… Or Maybe Not

I wanted to follow up about what I discussed in last week’s video: the GDP number that came out on Thursday. It showed another quarter of negative growth, which leads to ongoing conversation that the recession has started. I wanted to add…

Read More August 3, 2022

Fed Day Today and GDP Tomorrow

There are big updates today that a lot of people are paying attention to: it was established that the Fed increased rates by 3/4 of a point. If you look at the charts behind me, you’ll see the green numbers which show…

Read More July 27, 2022

Existing Home Sales Surprisingly Strong!

We received data for existing home sales in June, and the numbers are worth taking a look at. Obviously, this is a report that comes out every month – and we’ve been paying more attention to it than usual. There’s no question…

Read More July 20, 2022

Inflation is Still Running Hot, As Expected, But Don’t Panic!

Today’s topic is about the CPI (inflation) number that came out this morning: a record-high 9.1%. It’s definitely running high and we are all feeling it, of course. But this is totally to be expected and will continue happening for the next…

Read More July 14, 2022

The Latest Installment Of: Politicians Just Don’t Get It

Rumors were flying months ago, and now it looks like it’s going to happen… today’s topic is further proof that politicians are focused on votes and that’s all that matters. The recent announcement is that California has green-lighted checks up to $1,050…

Read More June 29, 2022

What’s More Painful Than Purchasing a House Right Now… RENTING!

What is more painful than buying a home right now, even with interest rates high and housing prices going up year over year? It’s renting! Double-Digit Increases in Rent Costs We have a report on rent costs around the country. The lowest…

Read More June 22, 2022

It’s Fed Day – So Far So Good

Today is Fed Day, and it’s been a doozy! Last Friday, the CPI number came in higher than expected, so there’s been a lot going on in the market. We’ve seen mortgage rates up by 3/4 of a percent! It hasn’t been…

Read More June 15, 2022

Jobs Report Friday… Why Does It Matter?

In a few days, on Friday, is the 1x per month jobs data number report. This comes out the first Friday of every month. It looks at the previous month’s jobs numbers and includes unemployment information. Why does it matter? It’s one…

Read More June 1, 2022

April Housing Data Still Looking Strong

The April housing data report came out, and it continues to show strong numbers. But some of what we have been talking about is indeed starting to happen. Here’s what you need to know: Year Over Year Inventory is Higher For example,…

Read More May 18, 2022

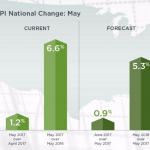

Peak Inflation… Probably Not Yet

Today, a big economic data point came out: Consumer Price Index (CPI). It’s an inflation number, which is an important hot button in the mortgage industry right now, because inflation is the main reason why interest rates are going up. Inflation is…

Read More May 11, 2022

Fed Day – Green is Good

It was highly anticipated that on Fed Day this week that rates would be raised by half a percent. One thing I want to point out with this Fed announcement is something that I’ve shared in the past: when the Fed raises…

Read More May 5, 2022

Housing is Still Looking Strong

This morning, important monthly housing data came out. The numbers show that the market is continuing to stay strong. There are some possible hurdles ahead, but things are still looking good currently. Annual Home Sales 5.77 million annualized units (which is strong…

Read More April 21, 2022

Hard Money Loans for Owner Occupied Properties

This week, we rolled out a product that I thought we’d never see. At Franklin Loan Center, we’re pretty good with hard money loans for people who need loans where income or employment doesn’t matter. But these types of loans are only…

Read More April 13, 2022

Are You Having a Difficult Time Getting Financing for a Property… We Can Probably Help

A topic that has been coming up as a byproduct of the current market: financing unique properties. I wanted to talk about this a little bit today to let you know that there are options available. Any Property Can Sell Right Now…

Read More April 6, 2022

I’m No Professor, But I Think This Might Be a Bad Idea…

This week I’m talking about a topic that isn’t necessarily real estate related, but it definitely has a tie-in: inflation. Here in California, we are hearing a lot about our state government working on a $400 giveaway for everybody because gas prices…

Read More March 30, 2022

The Fed Increased Rates By .25%. The Market is Skeptical

The Fed meets on Wednesday every six weeks, and this week they decided to increase the Fed Funds Rate by .25%. I’ve talked about this topic before, but it’s a good chance to review: does this rate change have any impact on…

Read More March 17, 2022

Uncertainty is the Name of the Game

The main topic of today: the uncertainty of what is happening with the economy and everything that is happening right now. The combination of COVID plus the news that is coming out of Ukraine is adding even more uncertainty to our situation….

Read More March 9, 2022

The Fed Says They’re Only Increasing Rates by 25%. It’s Not What It Seems…

Earlier today, The Fed was in front of congress and talking about the direction we are going with rates. One thing they said seemed to be great news on the surface – regarding a small increase in rates. Note: remember that we…

Read More March 2, 2022

Significant Changes for Self-Employed Clients Looking to Get a Mortgage

Today, I’m sharing news about big changes that just rolled out regarding conventional loans for people who are self-employed. Are You Self Employed? If you are running a company or are a member of a corporation, LLC, or a partnership (holding 25%…

Read More February 16, 2022

What’s Really Happening with Interest Rates?

In today’s video, I’m sharing some geeky charts so we can what is happening to interest rates and where we stand right now – and where I think we are heading (based on my opinion). Breaking Down Interest Rates In this chart,…

Read More January 19, 2022

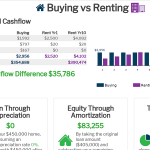

How Do the Numbers for a Home Purchase Compare to Renting?

It’s been a while since I shared a video on a rent vs. buy scenario. In the real estate business, there is always a mindset: you need to live somewhere – might as well be smart with your spending. If you are…

Read More January 13, 2022

Update: How Have the Bond Markets Responded to Last Week’s Fed Announcement?

I want to follow up about the big Fed announcement from last week. Some of the experts that I’m following were predicting that the Fed would double the amount of tapering of bonds that they are buying (both treasuries and mortgage-backed securities)….

Read More December 23, 2021

What Will the Fed Do About Inflation?

One of the biggest talking points in the financial industry right now is the topic of inflation. We are seeing the prices go up across all industries, which means that we are paying more for stuff compared to the prices just a…

Read More December 15, 2021

Here’s a Way to Look at Housing Price Activity I Haven’t Seen Before

There’s no question at this point that housing prices are going up and up. But part of the challenge with looking at median home prices is that these increases can be a little misleading. Especially here in Southern California: when the high…

Read More December 8, 2021

New Loan Limits: What Home Buyers Need to Know

The big news in the mortgage industry is that we have new conforming and FHA loan limits for 2022! New Loan Limits for Conventional and FHA Loans Starting right away for conventional loans, the new limit across the United States is $647,200….

Read More December 2, 2021

Slowing Appreciation Starting to Show Up in the Charts

Today, I want to revisit a chart that we looked at a few months ago. I’m bringing it up again because we’ve received new housing data in recent days, and it is still showing low inventory. What is Affecting Low Inventory? There…

Read More November 18, 2021

Zillow is Shutting Down Their iBuyer Program

There’s a big headline in the news: Zillow is shutting down their iBuyer program. It’s interesting to see how Zillow stepped in confidently – following the algorithms (their “Zestimates”), making blind offers on properties, sending someone to do a quick inspection, and…

Read More November 3, 2021

Home Appreciation is Slowing… That’s the Good News!

A report came out yesterday: the FHFA Housing Price Index. The update was all over the media outlets, with lots of people talking about a possible housing crash. This report shows that housing appreciation is slowing down across the nation. My opinion…

Read More October 27, 2021

New Conforming Loan Limits

This topic has been all over the news lately: the new loan limits. Every year, Fannie Mae and Freddie Mac re-evaluate conventional loan limits. They go back to look at how much appreciation they saw in Q3, then they increase the loan…

Read More October 21, 2021

Does Today’s Housing Market Resemble 2006?

With the escalation we’ve seen in home prices over the past few years, many fear that we may be headed for another housing “bubble” and that a crash is just around the corner. So are we truly in the same place as…

Read More October 13, 2021

How Could Threats of a Change in Long Term Capital Gains Affect Real Estate?

As we start Q4 this year, there is a lot of talk out of Washington D.C. about a possibility of an increase in the short-term capital gains tax. It feels like a situation where there has been so much in real estate…

Read More October 7, 2021

It’s Fed Day! I Hope These Fed Presidents Know What They are Doing…

Anyone in the mortgage or real estate business needs to be paying attention to what is happening in the Fed meeting and the announcement. Today was day 2 of the meeting, where they always make an announcement at 11 am PST. I…

Read More September 22, 2021

Franklin Rolls Out New Down Payment Assistance Program

Great news: we just rolled out a new down payment assistance program. This option is for first-time home buyers. With prices going up, the down payment is getting harder to achieve. There is a big cross-section in the world that assumes you…

Read More September 15, 2021

How Much Equity is Available?

There was a headline today that jumped out at me – it speaks to what is really happening in the housing market right now. People are wondering if the current trends are sustainable and whether we have a big crash coming. The…

Read More September 8, 2021

An Interesting Look at Where Housing Prices are Today

In today’s video, I’m sharing data from a presentation that we do every month. This information shows an interesting perspective to show the run-up in prices that we are seeing recently. I think it makes a strong justification that maybe the market…

Read More August 11, 2021

Mortgage Rates in a Downward Trend. Can it Last?

I want to talk about rates today. Rates have been so great for a while that it seems like we are used to the low numbers that we’ve been seeing for some time. Interest Rate Trends So Far in 2021 They have…

Read More August 4, 2021

Actual Appreciation VS. Median Home Price

Today I want to talk about what is going on with the housing market and current housing prices. If you’ve been paying attention, you can see that the real estate market is still on fire. Last week, we got year-over-year median home…

Read More June 30, 2021

Moving to Another State… Franklin Likely Has You Covered

I was out of town this week, and it reminded me that I haven’t really talked about how many states that Franklin is licensed in. Personally, I can help with mortgages in California and Washington. I’ve got those 2 state licenses. If…

Read More June 10, 2021

The Fix for Inflation… Who Agrees with Me?

Who agrees with me on fixing inflation? The inflation numbers are showing that things are out of control. I think these numbers are actually worse than what is being reported. The most obvious fix: we have to stop the “Great American Giveaway.”…

Read More June 3, 2021

Housing Price Appreciation is Accelerating

Yesterday, a new housing report came out – it was another doozy in the housing market. The numbers show that nationally we are up more than 13% year-over-year. That’s higher than it was last month, which means that things are accelerating faster….

Read More May 26, 2021

Inflation has a Huge Jump – What Does it Mean for Real Estate?

Inflation is kicking in – does it matter? I’m talking about this topic in today’s video because of the Consumer Price Index (CPI) report this morning. The numbers were 3 – 4x of expectations, and those expectations were already higher than normal….

Read More May 12, 2021

Federal Judge Overturns National Eviction Ban

A saw a headline on CNBC: Federal Judge Overturns National Eviction Ban. The article is quick to mention that it may not have the immediate effect of all landlords being able to evict people right away. But it certainly appears to be…

Read More May 5, 2021

Federal Assistance to First Time Home Buyers Right Now? Are You Kidding Me?!

I mentioned this topic a few months ago – but I’m amazed that it’s actually trying to fight its way through congress right now. There’s a bill released where they are trying to put together a $25,000 credit (in the form of…

Read More April 28, 2021

Showing Time vs SentriLock – Does it Even Matter?

This topic has nothing to do about the mortgage business, but is very related to the real estate industry – and I hope to start a conversation on this topic. Thanks to Bob Fox and National Real Estate Post for bringing this…

Read More April 21, 2021

Is There Any Good Argument for Purchasing a House Right Now?

The housing market is insane right now. It doesn’t matter where you are: Northern California, Southern California, Seattle, Idaho, etc. All of the markets that I can get data on are exploding right now. Of course, now there is a steady stream…

Read More April 14, 2021

Southern Cal Real Estate Numbers for March: Another Crazy Month!!

Every month, we get a real estate report – click here if you want to download the full report. Most of these comparisons are year-over-year, and the numbers are getting crazier with time. This month in particular is odd because a year…

Read More April 8, 2021

It Could Be a Pivotal Fed Day Today

It’s Fed day – I mention it every time the Fed meets. More often than not, it’s pretty mundane because the market is has already anticipated what is going to happen, so the news isn’t surprising. A Lot Hanging on the Fed…

Read More March 17, 2021

Rates May Increase – Will They Come Back Down?

It’s been a tough few weeks with interest rates running in the wrong direction. I’ve been looking to various resources to make sense of what is happening right now. Barry Habib offered great insight, particularly for those of you in the real…

Read More March 11, 2021

What is Zillow’s Plan?

Zillow has forever been the place to go when people want to check the value on their house, known as a “Zestimate.” Many regular consumers who aren’t in the industry didn’t realize that Zillow has been a big lead generation source for…

Read More March 3, 2021

The Forbearance Can is Continuing to Be Kicked

Headline this morning: Mortgage Delinquencies Fell Below 6% for the First Time Since March. That sounds like good news! What is 6% relative to? How does it shape up compared to where we really stand? Mortgage Delinquencies Are Down The good news…

Read More February 24, 2021

What is Real the Unemployment Rate?

Hint… it’s not what the Fed report says. Today I want to touch on the unemployment reports that we hear from the government each month – an announcement that always comes out the first Friday every month. It’s always a big number…

Read More February 10, 2021

Headline: Homebuyers Stall Due to Sticker Shock

I saw a headline on CNBC today that made me laugh: Homebuyers Stall Due to Sticker Shock. Is it true? There’s definitely a bunch of buyers out there, especially for this early in the year. Inventory is still low – it’s a…

Read More February 3, 2021

When Tax Credits are Actually Bad

Yesterday, I had 2 conversations that gave me the idea to address this topic in a video. One of the things that Biden talked about in his election campaign was a first-time homebuyer tax credit – up to $15,000. Why Real Estate…

Read More January 27, 2021

Touchy Investors in the Bond Market – What it Means for Mortgage Rates

It’s interesting to see how much things can change in just a week! So many events that have happened since my video last Wednesday, making it a challenge to keep up with everything that is going on. How do we tie these…

Read More January 13, 2021

Housing Finishes 2020 with a THUD! Nope!!

It’s the last Wednesday in 2020! This year has been a mix of good and unusual circumstances. Pending home sales came out this morning. The headline makes it sound like the year might be ending on a bad note, potentially predicting what…

Read More December 30, 2020

A Serious Question About the Proposed Stimulus Checks

I need someone to objectively help me understand why we are talking about giving tons of money in stimulus checks to everyone in the United States. I realize it’s not everyone because there are limitations on income, etc. But, why are we…

Read More December 23, 2020

Fed Announces They are Staying Involved in Bond Purchases

It’s Fed day, which always gives us a chance to talk about how the mortgage industry is affected by these announcements. To reiterate: they always make an announcement about the Fed funds rate, but this rate is a completely different rate than…

Read More December 16, 2020

So Much for the Cyclical Year End Slow Down…

Going into the holidays, we typically see a cyclical slowdown in the real estate market during this time of year. Today I looked at November’s stats to see the current trends in the market, and it’s clear that this slowdown isn’t happening…

Read More December 9, 2020

Is December a Good Time to Sell Your Home?

Every year during this time, we hear about the same topic from homeowners: is it a good month to buy or sell? Or, should I wait until the new year? Volumes tend to nosedive in December when it comes to real estate…

Read More December 2, 2020

The News Cycles Continue… What’s the Impact?

As a follow-up to last week’s topic, I’m still watching the news headlines to see what is going on in our country. These news stories impact the financial markets, which has an impact on interest rates – so I want to see…

Read More November 11, 2020

Since There is Nothing Happening in the News… Today We Talk About Knitting!

There’s not really anything going on in the news today… since it’s super slow, I figured we’d talk about knitting! Yeah right! Can you hear the sarcasm coming through? Who Knows What to Expect? Here we are, it’s 2020 – the election…

Read More November 4, 2020

Don’t Assume Mortgage Rates Will Be This Low Forever

We’ve seen rates really low in recent months, and mortgage rates continue to hang in there at these low levels. But I don’t want us to get lulled into believing that these rates will be here forever. Current Conditions Affecting Mortgage Rates…

Read More October 28, 2020

It’s All About Slow and Steady

The insanity leading up to this election is almost more than I can handle! So, I’m asking myself: where do we find sanity, where do we take some control back? First thing: turn off your TV and social media. I’m thinking about…

Read More October 21, 2020

September Housing Data… Unbelievable!!!

We just got information about the September 2020 housing data – click here if you’d like to see a copy of the report. There are some crazy stats that continue to blow me away. There’s no doubt about it… the market is…

Read More October 14, 2020

Housing Affordability… What’s the Real Story???

Recently two experts have set me straight on what is going on with housing affordability: Walter Neil (the CEO of Franklin Loan Center), and also Barry Habib (a mortgage-backed securities guru). These guys both look at the numbers at a high level….

Read More October 7, 2020

CA Prop 15 – Non-Political

Let’s talk a little bit about Prop 15 today. I’ve always promised no politics in my updates, and I feel like this is an appropriate topic because I don’t see it as a political thing. For anyone who doesn’t know, Proposition 15…

Read More September 30, 2020

What’s Driving Real Estate?

Last week, Walter Neil (CEO of Franklin Loan Center), put on a presentation about the real estate market where he talked about what’s driving the industry right now. Today, I want to pass along a few nuggets that I thought were super…

Read More September 23, 2020

The Fed Says…Low Rates Forever???

Today was another Fed meeting – day 2 of their regularly scheduled meeting. They came out with their announcement. I like to talk about this every time they meet since these announcements shine light on economic factors in our country. Rates are…

Read More September 16, 2020

Market Data Event: Wednesday, September 16th

Two things I want to cover today to keep you updated about what is going on right now: #1 – Market Data Event Next week, Franklin Loan Center is putting on a full market update, really geared towards the real estate community….

Read More September 9, 2020

The Eviction Moratorium – a Catch 22

One significant catch-22 we’re facing with COVID-19 and everything else that is going on right now in the economy is the eviction moratorium. Eviction Moratorium Thru the End of 2020 It was announced earlier today that the Trump administration has pushed the…

Read More September 2, 2020

Homeownership Rates Up. Is That All Good News?

A report came out yesterday regarding homeownership rates. These rates have been on a steady include over the last several years. It got me wondering: last time we hit a peak in homeownership was 2006, and we all know how that ended!…

Read More August 5, 2020

It’s Fed Day! Wait… What???

I might be the only guy that gets excited about Fed day! Today marked day 2 of the Fed meeting, and there were no surprises. If anything, the Fed sounded a little dejected about the market. There is no reason to start…

Read More July 30, 2020

Here We Go Again?

The big news of the week is that we are going back to a partial shutdown again. These are crazy, unprecedented times – it’s hard to know what to say about it. We are back to conversations about who is essential and…

Read More July 16, 2020

Save BIG on Real Estate Over the Long Haul

Last week, I talked about how to save a ton of money by taking advantage of today’s interest rates – which is a ton of money on the mortgage front. It made me think: why not tell my own story about what…

Read More July 8, 2020

How to Save Nearly $100,000 on Purchasing a Home

Did the headline catch your attention? There is a simple solution if you are looking for a way to save $100,000 when buying a house: buy now, instead of a year ago when rates were 1% higher! Interest Rates: 2020 Compared to…

Read More July 2, 2020

It’s All About Supply and Demand

The market is showing amazing resilience – particularly in the purchase market and the things that are happening here in the Temecula area and Southwest Riverside County. I know that there are differing results across the country, with other pockets of areas…

Read More June 18, 2020

Good News from the Fed

Instead of recording my video in the morning like usual, I waited until after the Fed announcement today. They announced that rates are staying at zero – which is no surprise. One surprising bit of news is that they expect rates to…

Read More June 11, 2020

The Housing Market is the Brightest Spot in the Economy

First, I wanted to send out a big THANK YOU for the major love I’ve received in response to my 50th birthday yesterday. Thank you for the messages and well-wishes! Unexpected Results in COVID-19 Walter Neil, the owner of Franklin Loan Center,…

Read More June 3, 2020

Realtors and Home Buyers: Good News on the Forbearance Front

We heard a great update last week from Fannie Mae and Freddy Mac regarding conventional loans. We are finally going to be able to let loose a bit to get some of the loans going again if they went into forbearance. A…

Read More May 27, 2020

Jumbo Lending Showing Signs of a Bit of a Thaw

I have a bit of good news. In recent weeks, lending has been shrinking due to the pandemic and economic changes that have been happening. But things are starting to shift again, which is good news in the mortgage industry. Jumbo Loan…

Read More May 21, 2020

3 Good Things about the Mortgage Business You Should Know

It seems like everyone is talking about how the sky is falling, and we’re obviously feeling a little cooped up being stuck at home. Today, I wanted to share 3 great things that are going on in mortgage and real estate right…

Read More April 29, 2020

Join Us on April 23 at 9:00am: Tips for Keeping Your Business on Track During COVID-19

A quick announcement for you: On Thursday, April 23 I am putting on a free Zoom call with a handful of people from the real estate industry. It’s going to be a great call for anybody, even if you don’t work in…

Read More April 23, 2020

Be Cautious About the Quality of Your News Sources

Many of us are checking the news throughout the day right now. Not only do we have extra time at home, but everyone is looking for the latest updates on the current pandemic situation. While it’s important to stay up-to-date on…

Read More April 16, 2020

Current News: Updates in the Mortgage Biz This Week

It’s been another crazy week with a lot of changes going on in the mortgage and real estate industries. I wanted to share a few things that are brand new since the last time we talked: What You Need to Know about…

Read More April 8, 2020

Things are Fluid in Real Estate Right Now

It is amazing how much happens so quickly in such a short time right now! I wanted to share details about a few new updates in the industry – changes that have come about since my video last week. Real Estate is…

Read More April 2, 2020

Updates: This Week in Mortgage and Real Estate

What a week! It feels like every week goes by and we have a whole new set of circumstances that we couldn’t have anticipated. When you compare last Wednesday with this Wednesday, it’s a different picture: we are all kept inside the…

Read More March 25, 2020

Come Together: Leadership is What We Need

I do this video every week – and it’s amazing how much things have changed since last Wednesday. So many businesses are closing and a lot is going on around the world. A few days ago, Walter Neil (the owner of Franklin…

Read More March 19, 2020

What a Ride the Last Couple Weeks

If you’ve been paying attention to the news, you know that the financial markets have been going nuts – with big up days and big down days. There have been more down days than up, which creates a bit of uneasiness. How…

Read More March 12, 2020

How are the Big Moves in the Financial Markets Affecting Rates?

My phone has been blowing up with people asking questions about the current news headlines: The Fed dropping rates by .5 of a point, and the DOW average is moving fast. What is going on? Here’s what you need to know: Quick…

Read More March 4, 2020

Things to Watch for in the Economy

Last week I shared undeniable signs that show strength in the economy and real estate industry. In the spirit of being realistic, let’s look at the factors that could indicate signs that the economy is weakening. This information also came from Walter…

Read More January 29, 2020

Undeniable Signs of Strength in Real Estate

Today I’m going to highlight a few interesting things from our economic update conference last week. Every person that I’m working with right now shares their concerns about what is happening in the real estate market. Where are we? How are things…

Read More January 22, 2020

The More You Know… A Day of Market Updates

Today, I have a bunch of market updates to share with you. First, if you are local in Temecula, Murrieta, or in the Southwest Riverside County, Franklin Loan Center is having our market update event at the Board of Realtors. We’re pretty…

Read More January 15, 2020

REALTORS! See Franklin Loan Center’s CEO for a Real Estate Update

Happy New Year! It’s our first full week back in the office, and it feels good to get back into the regular schedule again. The holiday break is always fun, but I like the excitement when everyone returns to the office again….

Read More January 8, 2020

Top 50 Boomtowns…Menifee, Seattle and Bellevue on the List

I recently read an article by Smart Asset that listed the top 50 “Boom Towns” in the United States. A lot of these cities were in the Southeast, like South Carolina. I also noticed cities in Texas and Colorado dominate the top…

Read More December 11, 2019

New Conventional Loan Limits

Every year during this time, Fannie and Freddie roll out their new lending details for the next year. This week, the Federal Housing Financing Agency (FHFA) announced the 2020 loan limit. These new limits are essentially available today. New Lending Limits The…

Read More November 27, 2019

It’s Fed Day!

Happy Fed Day! Today is another Fed meeting. The way it works is that they have a 2-day meeting, then on Wednesday they announce whether they are going to make a move on the Fed Funds rate. When I recorded the video,…

Read More October 30, 2019

The Power of a Tweet…

This morning, I want to talk again about how small, simple things from our politicians can impact bigger trends economically. Sometimes we see the markets and rates whipping around because of one statement or another. Yes, big economic changes can have an…

Read More September 25, 2019

The Psychology of the Economy

I’m excited to have my special guest, Lexi Provost with us today – talking about the psychology of the economy. Lexi recently graduated from UCSB with a psychology and brain science major. One thing that has been coming up in the real…

Read More September 18, 2019

Looking a Gift Horse in the Mouth?

Continuing with our conversation last week about low interest rates, I have to ask the question: are we looking a gift horse in the mouth? The gift I’m talking about is the drop in interest rates we are experiencing right now. 1%…

Read More August 28, 2019

Refinance Activity Up Dramatically Year Over Year

This morning I listened to a podcast that shared an interesting statistic: year over year, refinance activity is up 180%. Anyone in the loan business has seen an increase in demand for refinances. A bunch of activity has been happening right now,…

Read More August 21, 2019

What’s Happening in the Financial Markets Today?

If you’ve been paying attention to the financial markets today, you know that it’s been a rollercoaster on Wall Street. I checked the trends right before filming this video, and the Dow was down over 600 points. This is my 3rd week…

Read More August 14, 2019

What’s Really Happening with Interest Rates?

I talked about interest rates last week, and figured it was worth a discussion again this week because of all of the current news around the topic. Last week, I talked about how the Fed dropped rates by a quarter, which brought…

Read More August 8, 2019

It’s Fed Decision Day – But It May Not Be What You Think

Fed decision day has rolled around again, and I often highlight this topic in my video to share awareness about what is happening in the industry. The FED is finishing up their 2-day meeting today and should be finished shortly. Will Rates…

Read More July 31, 2019

The Difference Between Franklin Loan Center and Other Lenders

I pulled up some stats, and over the last 12 months over 2,000 loan officers have closed a loan in Riverside County alone! This stat shows how much competition there is in the industry, which raises the question: “Why should I…

Read More June 26, 2019

Everything is on Sale

It was another Fed meeting today, so it’s timely for me to talk about interest rates in my weekly video. The announcement was that they decided to hold the Fed funds rate, although there has been rumor that interest rates might continue…

Read More June 19, 2019

When Does it Make Sense to Refinance My Mortgage?

Rates have dropped, so it is natural that I am hearing more questions about mortgage refinancing. I know that I’ve talked about this topic a few times recently, but it’s always a relevant topic in the industry. When does it make sense…

Read More June 12, 2019

Make Your Home Beautiful

Today, I talked with Annette Rogers from AMI Designs. Her specialty is making your home beautiful! Not only does Annette help with individual projects for homeowners who want to update the décor at home. But these services are also available for realtors…

Read More June 5, 2019

Interest Rates are in the News Again

When the topic of interest rates hit the news channels, it’s common for everyone working in the real estate business to get many questions about this topic. Most of the calls I’ve received over the past few days are from clients who…

Read More May 29, 2019

How are the New Tariffs Affecting Mortgage Rates?

The trade war with China is dominating the news headlines right now. Everyone knows that economic news can affect interest rates, so many people are watching to see what will happen in the mortgage industry. Will these tariff changes have an impact…

Read More May 15, 2019

Real Estate Roadblocks – When is the Right Time to Buy?

This morning a read an article in the news that talked about how Uber and Lyft are both going public right now, and it is actually having an impact on Bay area real estate. People are pulling houses off the market waiting…

Read More April 17, 2019

Are Rates Too High to Buy a House Now?

One of my favorite homeownership myths to address is the topic of interest rate fluctuations. I’ve been hearing people complain about how much rates have gone up, making them think that it’s a bad time to buy real estate. One Fact to…

Read More March 6, 2019

Buyer Beware! Mortgage Companies Can Quote Anything

Last week I was talking about how rates have dropped, and I wanted to follow up on that topic to expand a little more. It’s exciting to see the dip in interest rates. What’s happening now is there is an uptick in…

Read More January 10, 2019

New Year, New Mortgage

Happy New Year! Now that 2019 is here, it’s time to think about your current mortgage and if any modifications need to be made. Whether you are considering a refinance or you are ready to buy a new home, I’m here to…

Read More January 2, 2019

It’s Fed Decision Day. Are Rates Going Up?

The Fed will be deciding again today whether rates will be going up. I always keep my network updated about the changes that are happening with mortgages, so I wanted to share some insight into what to expect with mortgage rates. I…

Read More December 20, 2018

Perspective in the Real Estate Market

It is undeniable that we’ve seen some changes in the real estate market. Changes always make people nervous. People are looking for answers about what it means: what should your takeaway be as you listen to all of the “news” in the…

Read More December 5, 2018

New Loan Limits Just Announced

New information has been released about the loan limits for conforming loans. This topic has been spreading all over social media already, but I wanted to share the details so that you understand your options. Yesterday, it was announced that lending limits…

Read More November 28, 2018

The Election is Over!!! Now What?

Are you feeling relieved now that the election is over? Regardless of politic opinions, many people felt that this election season was intense. It is exciting to know that we don’t have to see any ads about a politician who is most…

Read More November 7, 2018

Is the Housing Market Showing Some Scary Signs?

Happy Halloween! In my video today, I’m talking about something that seems scary to people: the trends in the real estate market. Is there anything that you need to be frightened about? I’ve read a few different articles recently that talked about…

Read More October 31, 2018

Rent Control: Prop 10

One of the things Californians will be voting in November is Prop 10. I won’t get into the details of the proposition, but the 30,000-foot view is that it’s deciding whether jurisdictions can pass rent controls on homeowners. Today I’m talking about…

Read More October 10, 2018

You Have to Borrow Money When You Don’t Need It!

The topic that I discussed in the video for the week is mainly a public service announcement, targeted for my contacts who are business owners or have an entrepreneurial mindset. Anyone who doesn’t work a salaried job has a high risk of…

Read More August 29, 2018

What You Need to Know If You are in the Fire Zones

Many fires are burning in the state and threatening homes in the area. This fire season has been awful, so it is important that homeowners understand a bit of information in case you are affected in any way. Even if your home…

Read More August 15, 2018

Down Payment Gifts for Public Employees

At Franklin Loan Center, we are always looking for the best solutions for our clients. There are many options available for down payment assistance, which often result in a $0 down option when you are preparing to buy a home. Sometimes, these…

Read More August 8, 2018

Words from a Wise Real Estate Investor

No… that wise real estate investor is not me. This advice comes from someone with a ton more experience than me and much richer than me. My dad’s cousin, Frank, was a very successful real estate investor, and he offered this advice…

Read More June 21, 2018

What is Happening with Interest Rates?

Today was another day that people in the finance industry anticipate: another Fed meeting. The announcement is that rates went up by .25% today, but that doesn’t mean your mortgage rate is up .25%. This has been a common trend and is…

Read More June 14, 2018

It’s Graduation Time! Who is Thinking about Downsizing?

It’s that time of year: high school students are graduating and preparing to move to college. At the same time, recent college graduates are moving away to start their careers. This topic touches the hearts of my wife and I because three…

Read More May 24, 2018

Perspective in Mortgage Rates: How Current Rates Compare to the Past

Today I want to bring some perspective on interest rates, helping you see the whole picture of the mortgage industry. Rates have been on an uptrend for 18 months, with a little bit of normal volatility along the way. Short-Term and Long-Term…

Read More May 10, 2018

The Vocabulary of Real Estate

Every industry has unique acronyms and terms that are used to talk about business, and real estate is no different. If you aren’t familiar with the industry terms, then it might feel like you need a translator to understand the conversations about…

Read More April 25, 2018

Selling Your House so You Can Rent??

Recently, I’ve had several people tell me that they are selling their real estate so they can wait for the crash, then buy back into the market again. From my perspective as a real estate professional, this idea doesn’t make sense. Here’s…

Read More April 11, 2018

You are Paying How Much in Rent!?!

Last week, I stumbled across an article that I thought would be a good starting point for our conversation today. The headline was talking about how millennials will spend almost $100,000 in rent between the ages of 22 and 30. Keep in…

Read More April 4, 2018

What Factors Influence Interest Rates?

After our discussion last week about how the Fed rate changes don’t have a big effect on mortgage interest rates, I thought it would be a good topic to discuss the things that DO impact interest rates. This topic gets a little…

Read More March 29, 2018

Fed Rate Hike: What it Means for Mortgage Rates

It’s that time again. Today is the 2nd day of the Fed meeting; it’s the first meeting with Jay Powell as our new Fed Reserve chairman. Every time there is a meeting, I talk about this topic. This month is no different…

Read More March 21, 2018

Should You Be Worried about the Swings in the Markets This Week?

When the national media is talking about the equities market, then it’s probably something that we need to look at. Have you been following the rollercoaster ride that has been happened in the markets this week? The swings have been huge, causing…

Read More February 8, 2018

State of the Union Address

The title of this video and post was my way of teasing you… I’ll never talk about politics on these videos. I would rather talk about hair product rather than the State of the Union address! So, instead of diving into the…

Read More February 1, 2018

Dealing with Insurance When Flood and Fire Happens

Nobody wants to consider the risk of a flood or fire in their home, but it can definitely happen. With all of the fires that have occurred in California, it is important to consider the financial implications if this natural disaster impacted…

Read More January 17, 2018

A Few More Details on How the 2018 Tax Changes Will Affect Real Estate

A few weeks ago, I shared a video after the new tax bill came through and mentioned how the proposed changes could affect the real estate market. At the time, I promised to share more information as it became available. So, this…

Read More January 10, 2018

Helping Our Agents with Marketing

2018 is here! We are excited about starting a New Year. 2017 had some great victories and challenges, and we are looking forward to seeing what 2018 has in store. My message today is geared towards realtors: here at Franklin Loan Center,…

Read More January 4, 2018

‘Tis the Season for Predictions

Can you believe that it is the last week of 2017? We hope that you had a great Christmas weekend, and enjoy the New Year celebrations with your family. At the end of each year, it seems to be the time when…

Read More December 27, 2017

How Will the Anticipated Tax Reform Impact Real Estate?

It looks like the tax reform will be passing, which means that many people are wondering how these changes will impact their personal and business interests. What effect will these changes have in the real estate industry? I’m always working hard to…

Read More December 20, 2017

Are Interest Rates Going Up Today?

Today is the 2nd day of the Fed meeting, and many people have been waiting to see if there will be a change in the interest rates. It is anticipated that the Fed will raise interest rates by .25%, but there is…

Read More December 13, 2017

Higher Loan Limits Announced!

Today I’m sharing details about a few pieces of news in the industry that you need to know. Whether you are in the real estate business or you are a homeowner, it is important to keep up with the trends. Here are…

Read More November 30, 2017

CA Props 60 and 90: Affordable Living for those 55+

Are you familiar with the proposed changes with Pros 60 and 90? I talked to a few people at the Board of Realtors about the proposed changes and the funding that is needed for the issue. To fund the enhancements, they are…

Read More November 8, 2017

The Benefits of Buying/Selling a Home During the Holiday Season

Halloween is over, which means that we are moving into the busiest holiday time of the year. Before we know it, Thanksgiving will be here and then we will be wrapping up 2017. Have you finished all of your home projects and…

Read More November 2, 2017

Is the Timing Right to Buy a New Home?

If you are thinking about purchasing a home, then you are probably asking the same question that we hear from so many people: is right now a good time to buy a home? No one has a solid answer for this question,…

Read More October 26, 2017

What to Do as a Real Estate Buyer in Q4 of 2017

This week, Cale Thomas of Elite Properties Direct joins me for my weekly live video and shares some very interesting facts and information… According to The National Association of Realtors, there is an “inventory problem” with respect to home sales. Simply put,…

Read More October 5, 2017

Low Down Payment? We Have That.

It is interesting to see the patterns in questions that we receive. Often, customers are asking about the same things, and a popular topic this week has been about low down payment options. So, I wanted to share a few thoughts and…

Read More August 31, 2017

Who’s in Your Network?

If you are like me, then you probably don’t spend enough time talking about the connections in your network. Since I have connections in the area, I can use these opportunities to help many clients and real estate partners find the services…

Read More August 17, 2017

Free Class: Tax Deferred Exchange

This week, I talked to Josh Pena from Exchange Resources, who joined us to discuss ways to defer your taxes when you have investment properties. Certain strategies can be used so that you can defer the tax on the gain. Is a…

Read More August 9, 2017

Why a Great Team is Essential for the Success of a Loan

Just last week we had a client who was buying a home for the first time. This client ran into issues with another lender and came to us looking for help. We were able to close the deal within 17 days of…

Read More August 2, 2017

Conventional Lending Guidelines are Easing

This weekend, Fannie Mae is releasing a new version of their automated underwriting software. This software really drives the vast majority of the lending that is done in the United States. So, it is a big deal that they are releasing changes…

Read More July 26, 2017

Is it a Still a Good Time to Buy Real Estate?

Since most real estate prices are elevated right now, many people are asking the same question: is it still a good time to buy real estate? Whether you are preparing to buy your first home or you feel like it is time…

Read More July 13, 2017

Data to Show the Strength of the Housing Market

As the market moves up and down, many people ask me about the outlook for real estate. Will home prices and interest rates continue going up, or will things change soon? The best thing that we can do is look at trends…

Read More July 6, 2017

Are You Gambling with Your Interest Rate?

This week, I am sharing my mortgage tip from Vegas! My daughter is at a dance competition, and I am here to support her. As I’ve been here, I’ve thought about the way that gambling can relate to mortgages in certain situations….

Read More June 29, 2017

No Closing Costs: Is it Too Good to Be True??

Have you seen the marketing ploys from mortgage companies that advertise no closing costs? Often, these marketing campaigns target homeowners who are interested in refinancing their mortgage. Don’t be fooled by messages that make claims that are too good to be true,…

Read More June 21, 2017

The Fed Meeting: What Does it Mean for Mortgage Rates?

Yesterday was the second day of the Fed meeting, which means that it was the time when Janet Yellen announced a decision on the Fed Funds Rate. What does that mean for your mortgage? What is the Fed Meeting? Janet Yellen is…

Read More June 15, 2017

The Big 3: Short Sale, Foreclosure, and Bankruptcy

Often, we hear questions from customers who are wondering how past financial problems will impact their ability to get a mortgage. If you have recently gone through one of “the big three,” will you be able to get financing for your home?…

Read More May 24, 2017

Rent vs. Buy: What is Right for Your Family?

As housing prices are increasing and rates are going up a little bit, many people are asking if it still makes sense to buy instead of rent. Before you make your decision, there are several factors that can help you determine the…

Read More May 17, 2017

Upgrading Your Home with the HERO or PACE Programs

Do you love the idea of adding energy efficient upgrades to your home and getting a tax break at the same time? The Property Assessed Clean Energy (PACE) Program is a financing tool for energy efficient upgrades for residential properties. Examples of…

Read More May 11, 2017

What Makes Mortgage Rates Go Up and Down?

Mortgage rates are a constant topic of conversation in the industry because many people are wondering how rate changes will impact their ability to buy a home. Even though rates are commonly talked about, it feels like these conversations have peaked because…

Read More May 3, 2017

Potential Pitfalls in Your Real Estate Transaction

When you are buying or selling a home, the hope is that the transaction will close without any major roadblocks or problems. But, it is common for pitfalls to come up, and we have seen some crazy things over the years….

Read More April 26, 2017

Tips for Buying a Home When the Inventory is Low

Last week we shared some statistics about the real estate market and how the inventory is affecting people who are buying or selling a home. To follow-up on this topic, today we are going to look at some of the strategies that…

Read More April 19, 2017

Real Estate Inventory: What is Really Happening in the Market?

The talk in the real estate industry is that there is a shortage of inventory, making it hard for home buyers to find a property for their family. In our weekly Facebook live broadcast, we talked to Cale Thomas, a local real…

Read More April 12, 2017

Debunking Myths about FED Interest Rate Changes

We often have an increase in questions about interest rates when the Fed meets to discuss changes in the rates. Since there was a meeting last week, we have decided to address this issue to help you understand how these changes will…

Read More March 22, 2017

Will Solar Installation Affect Your Ability to Buy or Sell a House?

Residential solar power is becoming more common as people are looking for ways to improve the energy efficiency of their home. If you are buying or selling a property that has solar panels, then there are a few things that might pop…

Read More March 8, 2017

Why Many Buyers Might Be Better Off With an ARM

With mortgage rates at record lows, it has been rare for buyer to opt for anything other than a fixed rate loan. However, as market conditions begin to sway and we’re seeing a slight uptick in rates, many buyers may be smart…

Read More March 2, 2017

Is a 15-year Mortgage Right for You?

When buying a home, some buyers have the ability and option to select a 15 year term rather than 30. The same can be true for refinancing. There are definitely benefits to a 15-year loan, including a lower interest rate, a shorter…

Read More February 23, 2017

Should You Worry About Interest Rates Trending Upward?

Over the past few months, we’ve seen a general trend of mortgage rates heading in an upward direction. Historically, this makes lenders, Realtors, and buyers a bit nervous. However, is there real reason to worry? Perhaps not. What do increasing rates REALLY…

Read More February 16, 2017

Increasing Mortgage Rates May Have Some Positives

Even though interest rates have been rising slightly, it isn’t necessarily bad news. I’ve always held this opinion and so do a number of industry experts. According to a recent article from Gina Pogol from The Mortgage Reports, increasing rates might even…

Read More February 9, 2017

A Few Thoughts on Your 2017 Mortgage Situation

We’re now in month two of 2017 (hard to believe)! If financing a home is on your to-do list for 2017, here are a few things you may want to keep in mind. Should you still consider buying a home? Buying a…

Read More February 2, 2017

Hold Off on That FHA Insurance Premium Reduction

A couple weeks ago, you might recall reports indicating that HUD was reducing the premiums charged for mortgage insurance by 0.25% beginning on January 27, 2017. For now, that plan has been suspended. Among fears that HUD may not have adequate reserves…

Read More January 26, 2017

Here’s What Homebuyers are Really Thinking…

Today I offer some food for thought to listing agents. Perhaps these hints can help you to sell your next listing a bit faster! It’s very common for real estate agents to use certain “buzz” words when describing their listings. Some time…

Read More January 19, 2017

FHA Reduces Insurance Premiums!

The department of U.S. Housing and Urban Development (HUD) announced on Monday that they will reducing the premiums charged on FHA insured mortgages by a quarter of a percent (.25%). HUD secretary Julian Castro stated that four years of growth and the…

Read More January 12, 2017

How to Know When It’s Time to Refi?

We’ve been talking about how great interest rates are for a few years now and when rates are low, there’s always that thought that maybe it would be advantageous to refinance the house. So how do you know if a refi actually…

Read More January 5, 2017

6 Real Estate Predictions for 2017

With the New Year upon us and a new president being ushered in about 3 weeks, many are wondering what might be in store for the Real Estate market in 2017. Here are some bold predictions based on the thoughts and opinions…

Read More December 29, 2016

Will Rising Mortgage Rates Impact Housing?

In case you haven’t noticed, mortgage rates are now at the highest level in two years and the Federal Reserve just raised rates on Wednesday. Even before the Fed’s move, the average rate on a 30-year fixed mortgage went up from record…

Read More December 15, 2016

Loan Limits Increase for 2017

Fannie Mae and Freddie Mac have announced an increase in the maximum conforming loan limit for 2017. This is big news since it is the first such increase since 2006. Beginning on January 1, 2017, the new conforming loan limit for a…

Read More December 8, 2016

Possible Real Estate Trends for 2017

As 2017 is quickly approaching, many people might be wondering what they can expect to see in the real estate market for the upcoming year. A recent article in The Fiscal Times outlined several real estate trends the experts predict for the…

Read More December 1, 2016

What’s in Store for the Mortgage Industry Post-Election

There will be numerous mortgage and housing related issues that President-elect Donald Trump will face once he takes office in January. According to National Mortgage News, the following is a synopsis of some of these important issues that will impact the mortgage…

Read More November 10, 2016

California Association of Realtors 2017 Market Forecast

According the 2017 California Housing Market Forecast, California’s housing market will post a nominal increase in 2017 as supply shortages and affordability constraints hamper market activity. The California Association of Realtors (CAR) forecasts a modest increase in existing home sales next year,…

Read More October 13, 2016

Fed Doesn’t Raise Rates… For Now

On Wednesday, the Federal Reserve decided that a stagnant unemployment rate is the main reason to hold off on an interest rate hike, according to USA Today reporter Paul Davidson. Janet Yellen, the Fed Chair explained to reporters that despite having solid…

Read More September 22, 2016

California Senate Bill 1150 Approved

Earlier this week, California’s Senate approved Senate Bill 1150, a new legislation designed to protect widows, widowers, and other heirs from unnecessary foreclosures. Called the Homeowner Survivor Bill of Rights, SBOR was approved by the Senate with 23 votes for it, and…

Read More August 25, 2016

CFPB to Offer New Rules for Troubled Borrowers

Due to the financial crisis during the last decade, the Consumer Financial Protection Bureau (CFPB) was created to protect home owners. Over the last several years, the CFPB has introduced various rules to help troubled borrowers, and last week, it updated additional…

Read More August 11, 2016

Presidential Candidates Policies on Housing and Finance Factors in Voting

With the presidential election less than five months away, one of the topics voters feel is highly important is the candidate’s policies on housing and finance. According to the results of a survey conducted for LoanDepot, 21% of Americans who responded to…

Read More June 23, 2016

Having that College Degree is an Advantage when it comes to Owning a Home

A recent article in the National Mortgage News by Jacob Passy brings to light how being well-educated today has never been more vital when it comes to being a homeowner. According to Passy, First American Financial Corp issued a report citing the…

Read More May 12, 2016

How are Lenders Performing with TRID?

A recent survey conducted by TD Bank’s Mortgage Service Index polled over 1,300 American homeowners over the past ten years who took out a home mortgage and found that even with the new TRID rule, home buyers reported a positive mortgage experience….

Read More April 28, 2016

4 Reasons to Be Excited About the Housing Market

Things are looking up in the housing market these days, for a number of reasons! Here are a few factors that may indicate the housing marketing could continue in a strong and stable direction for a while. Low Interest Rates Even…

Read More March 24, 2016

FED Leaves Rates Unchanged… For Now

Federal Reserve Board chairman, Janet Yellen, made her March statement yesterday, announcing that the FED would not be raising rates at this time. However, she also pointed out that ongoing economic growth and labor improvement could push inflation upward over the next…

Read More March 17, 2016

Great Opportunities Exist While Rates are Low

According to a recent article from CNBC, close to seven million homeowners aren’t taking advantage of the low mortgage rates and refinancing. Real Estate reporter Diana Olick explained that after the Federal Reserve raised its target interest rate in early December, it…

Read More March 10, 2016

Home Prices are Up, Rates are Down

Recent housing reports have indicated that across the county, housing prices are trending upward. The S&P/Case-Shiller 20-City Home Price Index, which is an index measuring home prices in 20 major metropolitan markets in the United States, rose 5.7% in December. While this…

Read More March 3, 2016

Mortgage Application Volume Rebounds and Increases

Those in the mortgage industry concerned about the sharp drop in mortgage activity over the holiday season don’t have to worry. According to a recent article by Diana Olick from CNBC and the Mortgage Bankers Association, mortgage application volume increased 21.3% last…

Read More January 14, 2016

More on the Federal Reserve Rate Increase

As I am sure you know by now, the Federal Reserve approved a quarter-point increase in its target funds rate on Wednesday, December 16. This was expected. The decision was given approval from the Federal Open Market Committee (FOMC) and marks the…

Read More December 24, 2015

How Will the Fed Rate Hike Affect Your Wallet

By now, you’ve probably heard that the Federal Reserve Board did raise the prime lending rate by .25% on December 16, marketing the first such hike since 2006. What exactly will this mean for you and your budget? Let’s examine a few…

Read More December 17, 2015

Information About Second Mortgages

In my last blog article, I provided information on Home Equity Lines of Credit (HELOC). Sometimes, however, that can be referred to by a different name. Many homeowners have heard the term “second mortgage,” but not everyone knows exactly what it is…

Read More November 12, 2015

The Investment Value of Your Primary Residence

For this week, I am going to do something that I really don’t do and that is an opinion piece. We are going on 8-10 years since the significant fallout from real estate. And, more and more, I am starting to…

Read More October 22, 2015

Check Out My Fully Vetted Yellow Pages

One thing that I take very seriously is the effort I make to stay connected to other professionals within my service areas. This means getting to know other business owners on a personal level, understanding their businesses, and vetting service providers that…

Read More September 3, 2015

Supreme Court Ruling May Boost Mortgage Demand

According to a recent article by Bonnie Sinnock, the Supreme Court’s decision that makes same-sex marriage legal across the nation might boost mortgage demand as it will provide gay and lesbian couples with more financing opportunities and stronger joint property rights. Shoshana…

Read More July 8, 2015

Is a HELOC Cash Crunch on the Way?

During the height of the real estate bubble of 2004-2007, may homeowners opened a HELOC (home equity line of credit). This was a popular way for homeowners to tap into their home equity to fund purchases, including home improvements and education expenses….

Read More June 25, 2015

TRID Changes Postponed

Many of you are probably already familiar with the fact the changes are on the horizon with respect to real estate and lending disclosures. TRID (TILA, RESPA Integrated Disclosure) was initially targeted to go into effect on August 1, 2015 but has…

Read More June 17, 2015

Freddie Mac Releases Mortgage Rate Forecast for 2016

Government-owned Freddie Mac recently issued its mortgage rate forecast for 2016. This forecast comes from Freddie Mac’s broader report titled, “May 2015 U.S. Economic and Housing Market Outlook.” The report explains that according to Freddie Mac’s estimation, the average rate for a…

Read More May 28, 2015

Freddie Mac Suggests 2015 Could be a Great Year

According to Freddie Mac, 2015 could be the best year for home sales and new home construction since 2007, which is great news for all involved in the mortgage industry. Deputy Chief Economist Len Kiefer recently said, “This month kicks off the…

Read More March 26, 2015

Why is This Spring a Great Time to Buy a Home?

Spring is in the air and it is definitely a great time to think about purchasing a home and stop paying rent. Lawrence Yun, the chief economist at the National Association of Realtors recently said, “The cost of renting is really high…

Read More March 12, 2015

Refinancing Your Home Still a Great Deal

Refinancing your home is always a big financial decision. And, with the mortgage rates still very low, if you’re a homeowner who has good credit and a steady job, it could be an excellent time to seriously think about refinancing. According to…

Read More February 26, 2015

Money Saving Tips to Consider

Saving money has continually been something that we would all love to do, but unfortunately, it just doesn’t seem to be that easy. A recent article by Michael Camacho gives individuals some insight on how to go about saving that hard-earned money…

Read More January 22, 2015

Now is a Great Time to Refinance

Even though most Americans probably aren’t thinking about refinancing or buying a home during to the holidays, the next few weeks may in fact be a great time to do so. According to Gibran Nicholas, chairman of CMPS Institute, an organization that…

Read More December 4, 2014

Important News About HOAs and Foreclosures

There is some disturbing news out of Nevada concerning homeowners associations (HOAs) and foreclosures. According to a recent article in Mortgage News Daily, the Nevada Supreme Court has upheld a law which allows an HOA to foreclose on homes ahead of first…

Read More October 16, 2014

Mortgage News Network Set to Launch

In the highly competitive mortgage industry, there can never be too many places to get information that may help give you the edge and increase your knowledge. Starting Monday, October 13, Mortgage News Network, an online-exclusive video resource offering programming for professionals…

Read More October 9, 2014

Should I Sell My Own Home?

If you or someone you know is debating on selling a home as “For Sale By Owner”, think long and hard before making this decision. You could be walking into a legal and financial nightmare. Take a quick look at the video…

Read More October 2, 2014

Foreclosures Up? Opportunities for Investors?

This week there was news that more foreclosed homes are on the market again in August. The cause of this activity is homes that went through a foreclosure years ago and banks are beginning to release more of this inventory into the…

Read More September 18, 2014

Reasons Behind Decrease in Mortgage Originations

According to a recent post by Freddie Mac analysts, home buyers are not taking advantage of lower interest rates, as indicated by a decrease in mortgage originations. These analysts identified three main factors for this decrease. The first reason is that the…

Read More August 28, 2014

The Importance of Knowing Your Credit Score

Every potential home buyer knows the importance credit scores play in getting a good interest rate on a mortgage or qualifying for a mortgage at all. Knowing your credit score is vital to understanding where you stand in getting a mortgage with…

Read More August 21, 2014

Is Paying off Your Mortgage a Good Idea?

With all of the financial responsibilities most people have, that elusive idea or dream of having financial freedom is something everyone continually thinks about. The majority of homeowners know that their mortgage is a major factor that is preventing them from this…

Read More August 14, 2014

Where is the Housing Market Headed?

I get asked this question quite often and I want to provide you with my opinion as to where the housing market is headed in the coming months. Take a quick look at the video below and feel free to contact me…

Read More August 7, 2014

Foreclosure Scams are Still Causing Problems

Unfortunately, many homeowners are still struggling with the possibility of foreclosure. And, where there are foreclosures, there are foreclosure modification scams. It is imperative to understand that these scams can only lead to more stress and problems for the homeowners and if…

Read More July 9, 2014

What are Your Rights Concerning a Solar Energy System and Your HOA?

Many homeowners live in a neighborhood where they have homeowners’ associations, also know as HOAs. There can be many positives with an HOA, but on the other hand, there can also be some restrictions as to what a homeowner can do with…

Read More June 12, 2014

The Spring Selling and Buying Season is Here

It definitely appears that the “Spring Selling Season” may have finally arrived. According to the National Home Sales Snapshot, which was released by DataQuick, existing home sales improved for the third time in the past five weeks, including a 1.6% increase in…

Read More April 10, 2014

The Importance of Estate Planning

One decision that most homeowners would rather not think about deals with estate planning. But we all must realize how important it is to protect, preserve, and manage your estate if you become incapacitated or pass away. When is the right time…

Read More March 13, 2014

Jobs Reports and Interest Rates

Economic reports and data are released on a daily basis. Pending expectations for these reports will often dictate market conditions and could impact interest rates. Working with a mortgage lender who closely monitors these reports can be critical if you are looking…

Read More March 4, 2014

Mortgage Tips for 2014

If you are in the market to become a homeowner, it is very important to make sure you are prepared to act quickly when you find that ‘perfect’ home. And, with mortgage rates still at attractive rates, it is even more vital…

Read More February 27, 2014

Continued Decline in Mortgage Delinquencies a Positive for Housing Market

More great news in the mortgage industry came out this past week as the mortgage delinquency rate hit the lowest in five years and actually dropped below 4% for the first time since 2008! TransUnion’s latest ‘mortgage delinquency report’ said that the…

Read More February 20, 2014

Tax Time and Home Mortgage Points

Like it or not, it’s tax time again. And, in order to make sure things go as planned, if you purchased or refinanced a home in 2013 you should get a copy of your HUD to your CPA. (If you closed your…

Read More February 13, 2014

Important Home Equity Line of Credit Information

Back in 2005, there was a plethora of Home Equity Line Of Credits (HELOC) made. And, with many of these still around and close to resetting, some borrowers may no longer be able to afford these credit lines when they are required…

Read More February 6, 2014

Is a Reverse Mortgage a Good Option?

One major conversation in the mortgage market is the reverse mortgage and its pros/cons. A reverse mortgage is a special type of home loan that lets you convert a portion of your home’s equity into cash. The equity that you built up…

Read More January 23, 2014

Signs Continue to Show Improvement in Housing Market

As 2014 begins, there are signs of continued improvement in the housing market. Various reports focusing on a lower number of delinquencies, an increase in home construction, and a lower number of loan modifications is great news on the mortgage front. A…

Read More January 16, 2014

Be Careful of Mortgage Scams

Due to the economy’s financial status and the housing market that is slowly recovering, home buyers need to be cautious of the possibility of various mortgage scams currently out there. A recent article from Polyana da Costa from Scripps Howard News Service…

Read More January 9, 2014

What’s In Store for the 2014 Housing Market

Many people in the housing industry are wondering what 2014 will be like after a very eventful 2013. And, according to a recent article in the USA Today, here is what is expected in the upcoming year. Probably the #1 main topic…

Read More January 2, 2014

Fannie Mae & Freddie Mac Raising Fees

Potential home buyers who do not have the money for a big down payment and with less than perfect credit scores may be facing an increase in mortgage costs starting next spring. According to a few different articles by Nick Timiraos, mortgage…

Read More December 26, 2013

What Is Single Payment Mortgage Insurance and Is It Right for You?