Rent vs. Buy: What is Right for Your Family?

Filed under: Market Comentary

As housing prices are increasing and rates are going up a little bit, many people are asking if it still makes sense to buy instead of rent. Before you make your decision, there are several factors that can help you determine the best choice for your family. It is important that you talk to an experienced lender and real estate agent to understand your options and put together a plan to find the right home.

Monthly Costs for Home Ownership

Yes, you will be paying more money every month to buy a home instead of renting a property. But, many people overlook the fact that there are other financial benefits outside of the regular payment. These are some of the benefits that you can expect from home ownership:

- Each payment helps to pay down the mortgage every month. Eventually, you can own the home without a monthly payment. If you choose to rent, then you are paying down the mortgage for your landlord, but you will never have a property to own in the end.

- Tax benefits are available for home ownership. Talk to your accountant to maximize the write-offs for interest costs and other expenses that might be incurred.

- Customizing your home is a great way to create the family culture that you desire. Investing in one-time upgrades will increase your long-term lifestyle without the need to spend money on décor and furniture each time you move into a new rental.

Looking at the Numbers

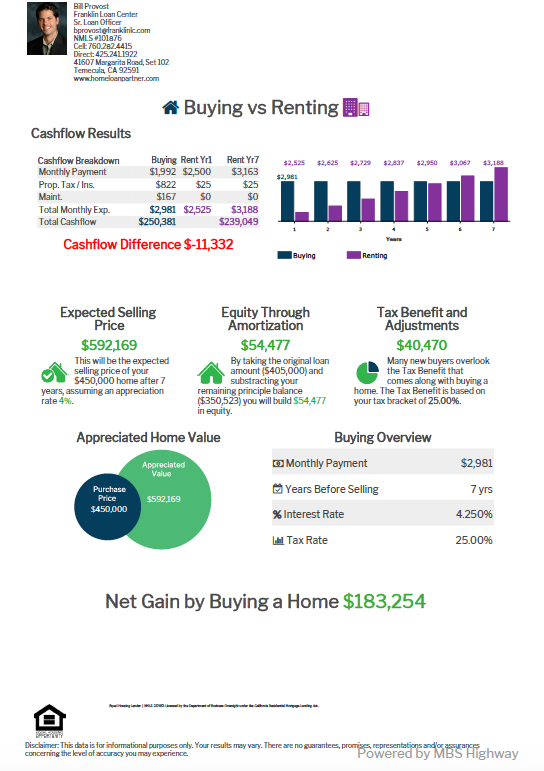

At Franklin Loan Center, we have several tools that are used to calculate the anticipated financial burden of home ownership. In this calculation, I assumed a $2,500 per month rent and compared it with buying a $450,000 home with 10% down. In this scenario, the mortgage payment would be about $2,900 per month, which is a monthly payment increase of about $500 each month.

But, you need to consider that rent will continue to go up over the years, and the mortgage will stay consistent if you have locked in the rates. Around the 5 or 6 year mark, the rental price of the home may actually exceed the monthly amount that you would be paying on a mortgage. Additionally, you will miss out on tax deductions and other benefits.

By comparing these numbers for a typical rent vs. buy scenario in Temecula over a seven-year period, if you include the amortization, tax benefits, and an estimated 4% increase in home value, it would be a total gain of almost $184,000 to purchase instead of rent. This figure is equalized considering the higher payments for the first five years.

As a renter or home buyer, it is important that you understand these numbers to see how your decisions are impacting the future for your family. If you are interested in running a personalized scenario, then you are always invited to contact us at Franklin Loan Center to learn more.

Franklin Loan Center | NMLS 237653

Licensed by the Department of Financial Protection and Innovation under the California Residential Mortgage Lending Act, 4131316

Franklin Loan Center | NMLS 237653

Licensed by the Department of Financial Protection and Innovation under the California Residential Mortgage Lending Act, 4131316