The Big 3: Short Sale, Foreclosure, and Bankruptcy

Filed under: Market Comentary

Often, we hear questions from customers who are wondering how past financial problems will impact their ability to get a mortgage. If you have recently gone through one of “the big three,” will you be able to get financing for your home?

These three things are short sales, foreclosure, and bankruptcy. Just because you have experienced one of these things, doesn’t mean that it is a financial death sentence for your family. The good news is that you have the opportunity to recover from these situations. Here are a few things that you need to know about how these things will affect your ability to buy a home again:

Waiting Period after a Big Financial Event

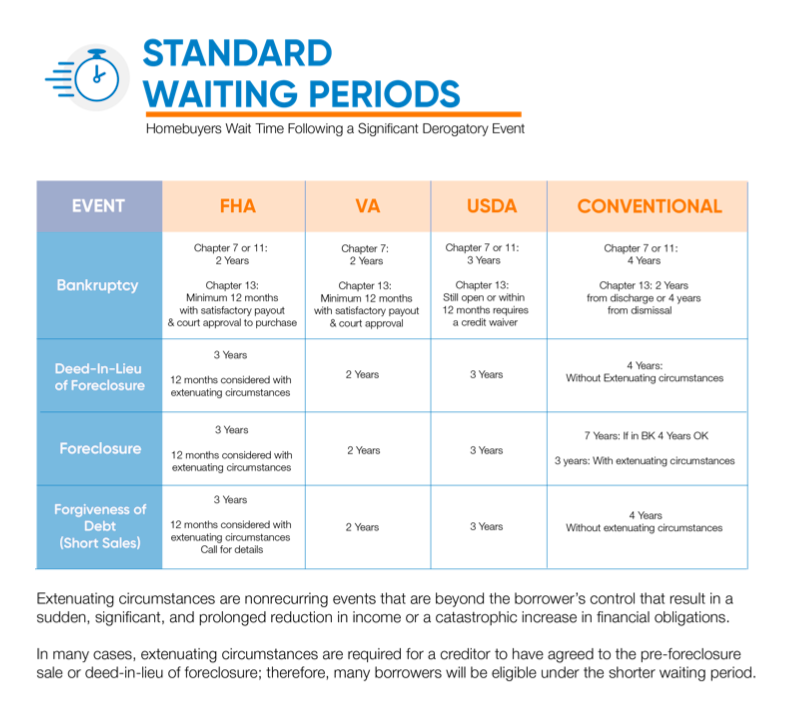

The bottom of the market was around 2010, which means that we are now seven years out from the time when many homeowners faced some of these problems. The longest that you need to wait after these financial events is seven years. So, that means that many people who struggled in 2010 are now free of that financial burden impacting their ability to get a mortgage.

Seven years is the worst-case scenario, with shorter waiting periods depending on the situation:

- FHA loans after bankruptcy require two years of waiting

- FHA loans after short sale or foreclosure require three years of waiting

- VA loans are two years after short sale, foreclosure, or bankruptcy

- Conventional loans are four years after bankruptcy or short sale

- Conventional loans require a seven-year waiting period after a foreclosure

Mortgages are Still Driven by Credit Scores

Keep in mind that approval for a mortgage is still based on your credit score. So, even if you have surpassed the timeframes listed above, those things could still be impacting your credit score and affect your loan. It is important that you do something to rebuild your credit so that you can qualify for the mortgage. Even then, there are certain types of loans that allow people to get financing with lower credit scores.

Also, there are extenuating circumstances for all of these situations. For example, if a crazy event happened, such as a sickness or death, then you might qualify for financing in a shorter period of time.

Do you need more information about your financial situation? Call me at Franklin Loan Center to learn about your options for loan qualification.

Franklin Loan Center | NMLS 237653

Licensed by the Department of Financial Protection and Innovation under the California Residential Mortgage Lending Act, 4131316

Franklin Loan Center | NMLS 237653

Licensed by the Department of Financial Protection and Innovation under the California Residential Mortgage Lending Act, 4131316