These Numbers Don’t Jive!

Filed under: Market Comentary

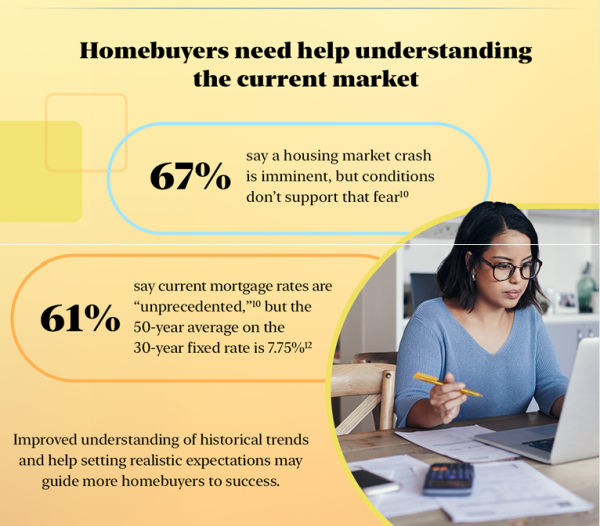

Today I want to run through some numbers because they are worth pointing out. This data is based on a survey done last month by NerdWallet. The two headlines:

- 67% of all buyers think there is a market crash coming

- 61% say that current mortgage rates are “unprecedented”

Regarding the interest rates: the truth is that 7.75% is the average interest rates over the last 50 years. A lot of homebuyers have never seen rates this high, especially first-time homebuyers.

Of course, in the late 70’s and early 80’s rates were up to 16 – 17%. Even if you take those numbers out, we are still currently at historical norms.

Is There a Crash Coming?

The second chart shows us months of inventory, going back to the last real crash in 2008. If we look at the numbers in 2008, there were 16.1 months of inventory available. That is essentially the beginning of the height of the crash. We had over a year and a third of inventory available at the time.

Now, we are under 2 months of inventory. What do I think about this current market? Yes, rates are elevated right now, which definitely creates some challenges. But I think it’s important to note that huge inventory is what causes crashes – and that’s definitely not what is happening right now.

In fact, inventory is actually dropping, not coming up.

These Numbers Don’t Line Up

No one knows what’s to come in the future months. I can’t find anyone who thinks there is going to be a big crash, and that is because there just isn’t enough inventory.

I wanted to share this information because it’s interesting to see that 2/3 of the people surveyed think that a crash is coming, but this assumption isn’t accurate because the numbers show differently. Don’t let the emotions of the headlines change your mindset about the industry, because the data is what really matters.

If you are thinking about buying a house right now, I would love to talk to you. Reach out any time to have a conversation with me.

Franklin Loan Center | NMLS 237653

Licensed by the Department of Financial Protection and Innovation under the California Residential Mortgage Lending Act, 4131316

Franklin Loan Center | NMLS 237653

Licensed by the Department of Financial Protection and Innovation under the California Residential Mortgage Lending Act, 4131316