What Makes Mortgage Rates Go Up and Down?

Filed under: Market Comentary

Mortgage rates are a constant topic of conversation in the industry because many people are wondering how rate changes will impact their ability to buy a home. Even though rates are commonly talked about, it feels like these conversations have peaked because of the political changes that have been happening in our country.

Understanding the historical trends for interest rates will help you see why the rates move and what we might expect in the future.

What Factors Will Move Rates?

We watch the interest rates move every day, which can be confusing to some of our customers. We want to help you gain perspective on why these fluctuations occur. Yes, we have higher rates compared to where rates were a year ago. But, there isn’t anything concerning about these trends.

Fannie May and Freddie Mac are the influences that affect the pricing of many of these loans. Mortgage-backed securities often have an influence on the rates that are set. These bonds are traded on the open market, and they fluctuate in a similar way to equities that are held on the market. You can watch the stocks move up and down, and those same fluctuations can happen to the securities that influence mortgage rates.

Generally, people buy bonds when they are feeling less secure about the economy. Then, those bonds are sold when the economy improves because they see other opportunities to maximize their ROI more effectively.  When the demand for bonds goes up, then it drives the rates down. Decreasing demands will drive the rates up. Over the past eight years, we have seen such low rates because of the insecurity in the market.

When the demand for bonds goes up, then it drives the rates down. Decreasing demands will drive the rates up. Over the past eight years, we have seen such low rates because of the insecurity in the market.

Historical Trends in the Industry

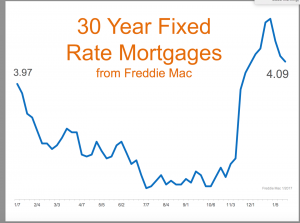

Looking at the charts, you will see the way the rates have changed because of political events that have happened in the country. For example, on Election Day last year, the rates rose by about 3/4 percent, which caused everybody to freak out about the changes.

Here is additional information that is interesting, showing the way the rates have changed over the past four decades. This chart shows that the rates are currently significantly lower than the typical rates that were offered in the past:

Talk to a Mortgage Professional

The truth is that there are so many factors that influence interest rates, including your credit score and financial stability. If you are interested in learning more about how changing interest rates will affect your mortgage, then the best thing that you can do is talk to a mortgage professional for personalized recommendations. Call us today to learn more!

Franklin Loan Center | NMLS 237653

Licensed by the Department of Financial Protection and Innovation under the California Residential Mortgage Lending Act, 4131316

Franklin Loan Center | NMLS 237653

Licensed by the Department of Financial Protection and Innovation under the California Residential Mortgage Lending Act, 4131316