Things to Watch for in the Economy

Filed under: Market Comentary

Last week I shared undeniable signs that show strength in the economy and real estate industry. In the spirit of being realistic, let’s look at the factors that could indicate signs that the economy is weakening. This information also came from Walter Neil’s presentation a few weeks ago.

Economic Expansion

We are in the longest economic expansion that the US has ever seen – well over 10 years. It won’t go forever. There’s no question that another recession will occur at some point. What we don’t know is when that will happen and what it will look like.

One thing I feel strongly about is: unlike the last downturn, the next recession won’t be led by real estate. Last time, the reason the economy buckled is because of the insanity that was happening in real estate lending, which influenced real estate prices, and more. It was a house of cards. Things will be different this next time around.

Two Economic Factors to Watch

Here are two things that you need to keep an eye on:

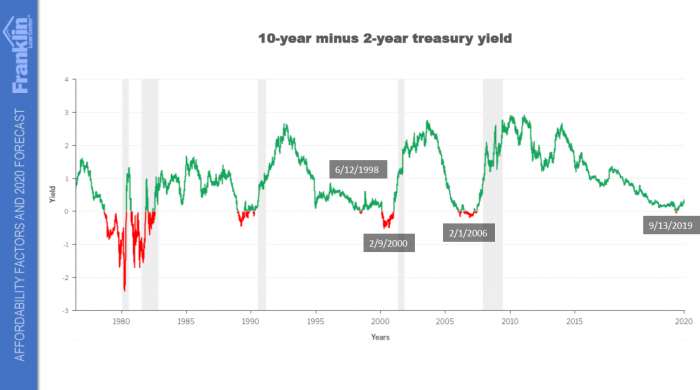

- Inverted Yield Curve: We are watching the 2-year treasury vs. the 10-year treasury. Reason says you would get a higher yield from the long-term investment. If the yield for the 2-year exceeds the 10-year yield, then it is a sign of weakness. It inverted a few months ago, and again as recently as yesterday.

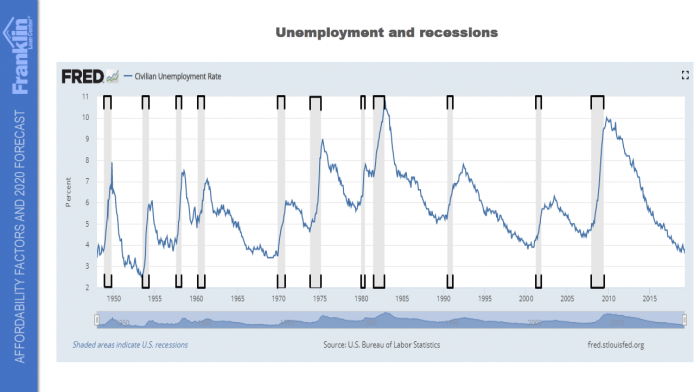

- Unemployment Rate: Without variance, after a trough in the unemployment rate, within a year the economy is headed into a recession. We are at a very low spot in unemployment right now (at 3.5% for the past few months). It’s hard to say if we are in a trough – it might go lower or stay where we are for a while. From the trough, if it starts creeping up, then it could be a predictor of an economic slowdown on the horizon.

These points don’t necessarily mean that we are going into recession right away. But it’s a good idea to pay attention to the trends.

Real Estate is Strong

One thing I love about where we are is that the real estate market is a strong part of our economy right now. Inventory is still low, which means that demand is there when new listings go on the market. At the same time, there are a few things to keep an eye on that could have an impact on the greater economy. Even still, real estate could stay strong through it all.

If you have questions, I’m always here to help! Call anytime.

Franklin Loan Center | NMLS 237653

Licensed by the Department of Financial Protection and Innovation under the California Residential Mortgage Lending Act, 4131316

Franklin Loan Center | NMLS 237653

Licensed by the Department of Financial Protection and Innovation under the California Residential Mortgage Lending Act, 4131316